We provide tailored advice on personal and business risk.

Services

Everyone’s different, so we start by learning about what you need and then making recommendations that suit your lifestyle and budget.

When you meet with us, we’ll explain the various types of insurance that are available and give you the information you need to choose the right cover.

We help you through the application paperwork and support you if you need to make a claim.

We give you guidance, tips and other specialist recommendations for other types of insurance and financial advice.

Private Health Insurance

Medical insurance lets you fast-track the public health system, so if you’re injured or unwell, you’ll have a shorter wait for treatment. It’s the fence at the top of the cliff: getting treatment when you need it can speed up your overall recovery and prevent you from being on a waiting list while your condition gets worse.

Medical insurance can also go towards the cost of any specialists you need to see and often gives you more choice than you would have in the public system.

Income & Mortgage Cover

If you’re unable to work due to illness or injury, Income & Mortgage Cover gives you access to an ongoing income. ACC doesn’t cover illness, so you aren’t able to receive ACC payments if you become unwell.

With Income & Mortgage Cover you will receive a percentage of your previous income helping you to cover your ongoing expenses whilst you focus on your recovery and return to work.

Trauma

Trauma Insurance provides a lump sum payment in the event you suffer from a serious illness. It means you won’t have to rush your return to work or worry about money whilst you’re getting back to full health.

This can work in partnership with your income/mortgage cover should this illness take you out of work for an extended period of time.

Total & Permanent Disability

If an accident or injury means you can’t keep doing the job you love, TPD insurance gives you access to a lump sum payment.

Having TPD cover in place means you have time to decide what happens next without the financial stress of being out of work.

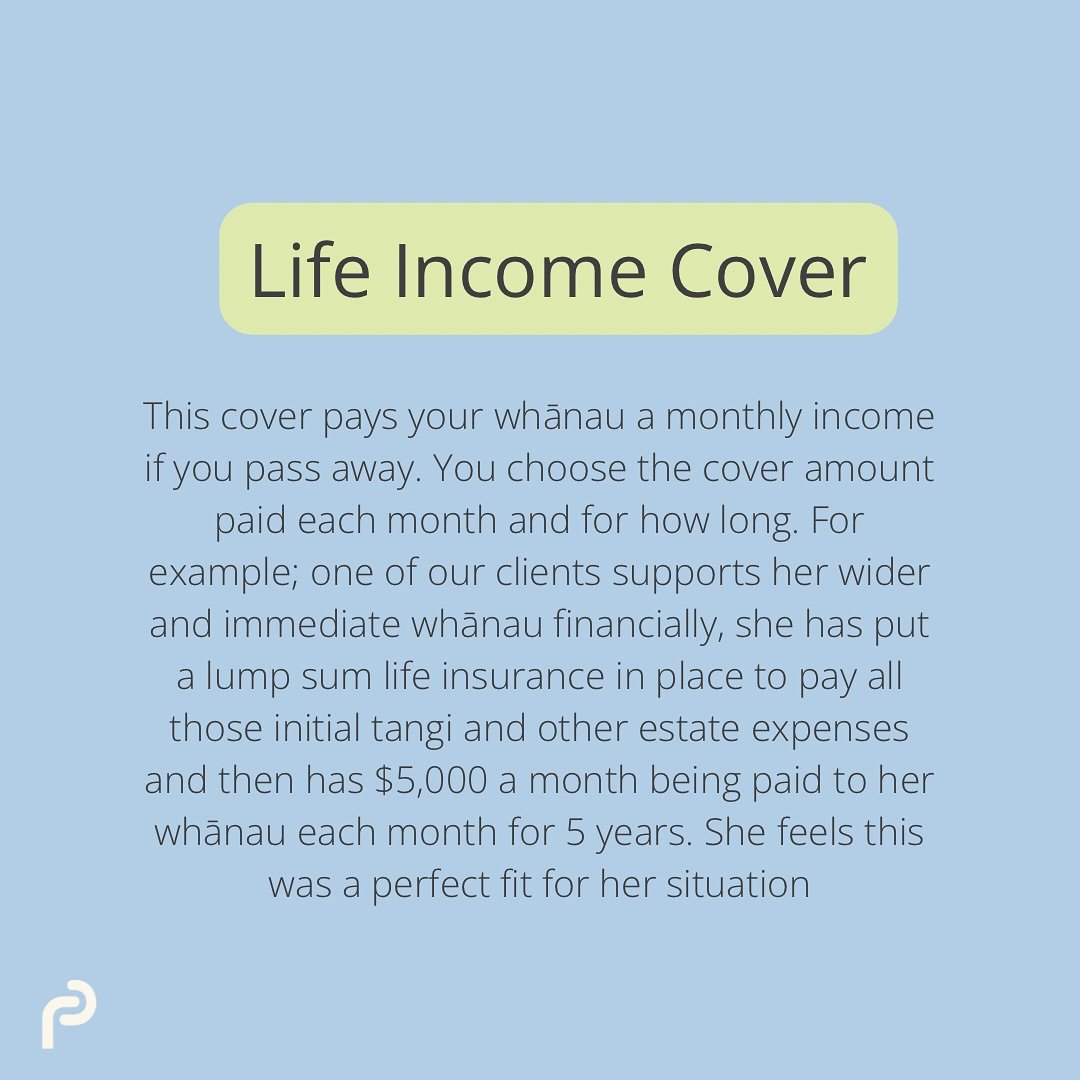

Life Insurance

Life insurance takes care of those left behind by reducing the financial impact of a loss. It’s something you put in place to make sure your loved ones will be OK if you pass away.

Life insurance can help your family keep living the same lifestyle without your income (for example, covering school expenses or the mortgage). It can also be used to take care of any debt, or cover your funeral costs.

The information on this website is intended to provide a brief overview of the services we provide. Everyone’s situation is different, and your insurance needs will vary depending on your individual circumstances. Always seek financial advice based on your personal situation.

Disclaimer

Ready to start your insurance advice journey with us?

We provide tailored advice on personal and business risk.

Keep up with us

@randpinsurance